Transparency Denied

The Holiday Fund Black Box

February 1, 2026

At 175 E Delaware Pl HOA, the Holiday Fund is administered by board-appointed co-chairs and distributes more than $100,000 a year to building staff. An owner asked for the formula. A committee co-chair accidentally replied saying the quiet part out loud: don’t provide it. What followed was a familiar pattern: delay, deny, deflect. That prompted a formal records request under Illinois law. The response so far has been simple: none. The deadline for the HOA to respond is Mon, Feb 2, 2026.

Brought to you by Drew McManus, your neighbor in 7908.

What Owners Were Told

Like clockwork, the HOA’s Holiday Fund Committee sends owners a cheerful appeal: contribute to the fund, show appreciation for staff, spread holiday goodwill. According to the committee, employees received payments based on tenure, with longer-serving staff receiving more and those employed less than five years receiving smaller amounts.

That’s the description. What owners have never seen is the math.

No percentages. No tiers. No breakdown showing how “tenure-based” translates into dollars. When asked to provide an anonymized accounting and confirmation of their formulas, the committee declined.

Owners fund this program on trust. How is withholding the math in owners’ best interest?

The Request

On Jan 13, 2026, I sent a written request to Holiday Fund Committee co-chairs Nike Whitcomb and Alicia Williams. The ask was straightforward:

- The distribution formula: the actual math used to calculate each disbursement.

- Policy on approved leave: whether employees on medical leave had their portions reduced.

- Financial records: bank statements and an anonymized line-item accounting of fees deducted before distribution.

I explicitly stated I was not requesting individual names, donor identities, or specific amounts tied to any person. I wanted the logic and the ledger that would verify $102,000 was distributed according to a consistent, documented standard.

Drew McManus, Jan 13, 2026

Dear Alicia and Nike,

I hope you are having a good start to the new year.

As a 175 E Delaware Pl homeowner, I am writing to request information regarding how the 175 East Delaware Place Holiday Fund was allocated this year. While I understand that the distribution is not based on an equal split, I would like to better understand the criteria used for our staff and contractors.

Specifically, I am requesting the following:

- The Distribution Formula: Please provide a copy of the criteria and/or formula used to determine the specific amounts awarded to HOA employees and Sudler’s contract staff.

- Policy on Approved Leave: I would like confirmation on whether employees who were on approved leave (such as for injury, extended illness, or other guaranteed medical leave) had their portion of the fund reduced or prorated based on their time away.

- Financial Records: Please provide copies of all bank statements associated with the Holiday Fund, as well as a line-item accounting of program costs including, but not limited to, third-party provider fees, processing fees, or management fees deducted from the fund before distribution.

To simplify this request and respect the privacy of my neighbors and staff, I am NOT requesting the following:

- Individual Disbursement Figures: I am not seeking the specific dollar amounts paid to any named individual.

- Donor Information: I am not requesting the names of owners who donated or the specific amounts contributed by any individual homeowner.

- Owner Lists: I am not requesting a list of donors; I am only interested in the aggregate totals and the subsequent math used for disbursement.

I am looking for the logic applied to the distribution and the financial records verifying the total amounts collected, the fees deducted, and the final amounts paid out in total. I acknowledge and appreciate the time the committee spends organizing this fund every year. Having this documentation will help provide clarity and ensure all residents that the funds are being handled consistently and fairly.

Thank you for your assistance. I look forward to receiving these documents by Tuesday, January 20, 2026.

Blue Skies,

Drew McManus

Unit 7908

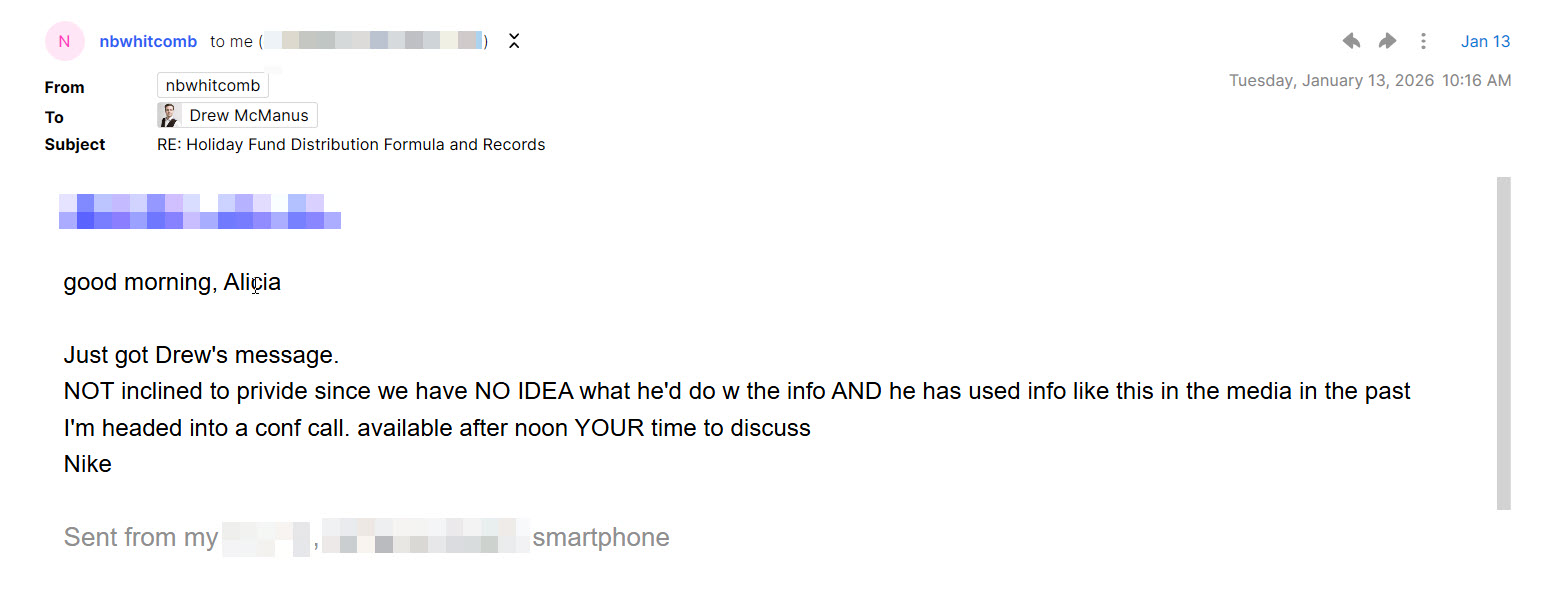

Saying The Quiet Part Out Loud

Within hours, Co-Chair Nike Whitcomb replied. But not to me…or so she thought.

Whitcomb intended to contact co-chair Alicia Williams with a recommendation. Instead, she sent it directly to me:

“good morning, Alicia

Just got Drew’s message. NOT inclined to privide [sic] since we have NO IDEA what he’d do w the info AND he has used info like this in the media in the past I’m headed into a conf call. available after noon YOUR time to discuss

Nike”

Whitcomb’s email-fail reply made two things clear:

- She was prepared to withhold basic documentation before the co-chairs had even discussed the request.

- The basis for that decision was not a policy or a privacy standard, but because of who was asking.

She used her personal judgment about the owner making the request and what they might do with the information.

That approach is not just improper, it is dangerous. What happens to the Association’s legal exposure when transparency depends on who is asking rather than documented rules and an auditable paper trail?

The Official Response

On Jan 16, 2026, Alicia Williams sent the committee’s formal reply. It constructed barriers where none needed to exist:

- On the formula: Williams confirmed the fund is “tenure-based” and that staff employed less than five years received smaller amounts. But she refused to provide any of the requested information about percentages, tiers, or any verifiable breakdown.

- On approved leave: Williams stated that leave is handled “on a case-by-case basis” through “consensus of the committee members.” No written policy. No documented standard. When pressed, she added: “As you know, there are many potential privacy issues for different types of leave and part-time work.” That substitutes caution for clarity. So how does the Association defend consistency and fairness without a documented rule?

- On financial records: Williams declined to provide bank statements by arguing they would “list everyone that contributes to the fund and the amount given.” But that was never my request. I did not ask for donor names or incoming deposits. I asked for an anonymized expenditure ledger and supporting records showing money going out: disbursements, fees, and any deductions taken before staff were paid. By attempting to shift the discussion to privacy, the committee avoided the transparency question owners are actually entitled to ask: how was the $102,000 handled and distributed?

- On headcount: The print flyer distributed to owners listed 31 employees. The email sent to owners on Jan 16, 2026 listed 33. Williams’ response claimed 32. No explanation for the discrepancies was offered.

Drew McManus, Jan 17, 2026

[…] please consider this a formal request for the inspection of association records pursuant to Section 19 of the Illinois Condominium Property Act (765 ILCS 605/19) and Chicago Municipal Code Section 13-72-080.

To fulfill this request, you are required to provide the following specific records:

1. The Distribution Formula & Validation Data

- The Criteria: The specific mathematical breakdown (tiers, percentages, or dollar amounts) used to calculate the disbursements. A vague reference to “tenure” is a description, not a formula.

- Headcount Confirmation: A definitive statement confirming the exact number of unique individuals who received a disbursement from the fund total. This is necessary to resolve the conflicting figures of 31, 32, and 33 recipients previously provided by the board and the committee.

- Validation Ledger: An anonymized list of the 32 specific amounts disbursed (e.g., “Recipient 1: $X, Recipient 2: $Y”). This list must have all names and titles removed. As I am not asking for the names attached to these amounts, there is no privacy concern. The purpose is solely to verify that the mathematical formula provided was applied consistently to match the $102,000 total.

2. Leave Policy and Impact

- The Policy Logic: The committee’s standardized policy regarding recipients on approved medical or injury leave (specifically, whether such leave results in a prorated reduction).

- Confirmation of Application: A direct confirmation as to whether any recipient(s) in this cycle had their portion of the fund reduced or prorated specifically due to time spent on approved leave.

- Note: Do not deny this request based on “medical privacy.” I am asking for a “Yes” or “No” confirmation regarding the application of a financial rule to the group, not the medical history of any individual.

3. Accounting of Administrative Costs & Resources

- Fund Expenditures: A line-item accounting of all expenditures, debits, or deductions from the Holiday Fund account for any purpose other than the direct disbursements to staff. This includes all third-party provider fees, Zelle-related charges, bank service fees, or management fees.

- Note: Do not deny this based on “donor privacy.” I am requesting records of money leaving the account (expenses), not the list of donors contributing to it.

- Association Resources: Any and all Association records—including but not limited to general ledger entries, invoices, or billing records—reflecting Association funds or resources used to facilitate the administration, collection, or distribution of the Holiday Fund.

Statement of Purpose: The purpose of this request is to verify the financial integrity of the fund, ensure the objective application of distribution rules, and audit the use of Association resources, including contracted management personnel and general funds, utilized to administer this program. This is a proper purpose relating to my interest as a unit owner.

Certification of Non-Commercial Use: I certify that the information obtained from these records will not be used for any commercial purpose or for any purpose that does not relate to my interest as an association member.

Per Illinois law, the Association is required to make these records available within ten (10) business days. Please let me know when these documents will be available for inspection or if they will be delivered electronically.

Regards,

Drew McManus

Unit 7908

The Board Meeting

On Jan 12, 2026, during the regular board meeting, a board member requested access to the Holiday Fund’s detailed financials, including payout distributions and percentages.

Board President Scott Timmerman refused.

When I followed up with Timmerman directly, asking him to clarify the Board’s position and the reason for withholding records, he replied: “I am unaware of any request by a Board member during the meeting.”

The meeting was recorded. The request is on the record. A separate board member attempted to recharacterize the request as asking for specific dollar amounts paid to individual employees; the requesting member corrected them and restated that they wanted the formula and percentages, not names.

So why is Board President Timmerman treating a request for a formula as if it were a request for private financial data? Likewise, why did he fail to respond to subsequent owner requests?

Drew McManus, Jan 14, 2026

Dear Scott,

I am writing because it seems like there is some confusion regarding the Holiday Fund financials following the January 12th, 2026 board meeting. It feels like the request for those records was seen as an overstep, so i I am trying to ensure I have a clear, on-the-record understanding.

During the session, a request was made by a Board Member for access to the detailed financials of the Holiday Fund. It was my understanding from the discussion that you directly denied this request.

If that is the case, is your denial based on the Fund being handled as a private entity separate from the Association’s jurisdiction?

Could you please confirm for the record if it is currently the Board’s position that these financial records are withheld from Board oversight? Is it the Board’s position that these are not Association records because the Fund is an independent entity?

How is the Board currently defining the Fund’s status so that I can ensure my future inquiries are directed to the right party?

Blue skies,

Drew McManus

7908

Scott Timmerman, Jan 14, 2026

Dear Drew,

I am unaware of any request by a Board member during the meeting. If you are referencing a prior request for the exact amounts given to each employee, the Holiday Fund Committee denied that request.

Scott Timmerman

Drew McManus, Jan 14, 2026

Hi Scott,

I appreciate the prompt reply. It seems like there is a gap between your memory of the meeting and what was actually recorded during the discussion. During the January 12th meeting, a request was specifically made for the Holiday Fund payout distributions and percentages, which was met with your refusal. While a separate member tried to misinterpret that request as asking for specific dollar amounts paid to employees, the requesting member corrected the record and reclarified that they were seeking the fund details.

Since you stated you were unaware of this request, what is the plan to provide these fund details to the member who requested them and the other directors?

Furthermore, what is the official reason for withholding this specific financial data, given that the Fund operates using Association assets, you appoint the committee chairs, it requires staff time, and appears multiple times in the official newsletter and email channels?

Blue skies,

Drew

Drew McManus, Jan 15, 2026

Good morning Scott,

I haven’t heard back from you regarding the status of the fund details or the Board’s official position on the transparency of the committee.

The recording of the January 12th meeting confirms that the request for the fund’s distribution percentages was made and subsequently refused. Your claim of being “unaware” of this request is contradicted by the record.

Moreover, you have not yet answered the following:

- What is the plan to provide the fund details to the member who requested them and the other directors?

- What is the official reason for withholding this specific financial data, given the Association assets and presidential appointments involved?

- What is the justification for the initial refusal during the meeting?

Blue skies,

Drew

The Accountability Gap

Here is what makes this more than a paperwork dispute.

Both Alicia Williams and Nike Whitcomb serve on the HOA Board of Directors. Both were appointed as Holiday Fund co-chairs by Board Chair Scott Timmerman. The fund uses Association communication channels (the newsletter, the email system), Association staff time to administer, and solicits contributions from owners using Association resources.

Yet when transparency is requested, the committee claims the fund operates on voluntary contributions and implies it falls outside normal oversight. When a board member asks for details during a board meeting, the Board President first refuses, then denies the request ever occurred.

How can the Association protect against its legal exposure if the Holiday Fund relies on Association infrastructure and board appointed directors, but is treated as exempt from the transparency and accountability standards that apply to Association business?

The “Consensus” Problem

Williams’ statement that leave-related adjustments are handled “by consensus” deserves particular attention.

“Consensus” without a written policy means decisions are made subjectively.

- If one employee on approved medical leave has their bonus reduced while another in similar circumstances does not, the Association has created different classes of employees based on undocumented criteria.

- That is not flexibility; it is legal exposure.

When asked directly whether any recipients in this cycle had their portion reduced due to approved leave, Williams did not answer. She cited “potential privacy issues” instead.

There was no request for medical histories. The request asked whether a financial rule was applied. Yes or no.

If the committee won’t answer a simple yes or no question about its own policy or explain how it is applied consistently, what conclusion are owners supposed to draw about whether a real policy exists at all?

The Formal Request

Unfortunately, the committee’s reply left one option. On Jan 17, 2026, I submitted a formal records request under Section 19 of the Illinois Condominium Property Act (765 ILCS 605/19) and Chicago Municipal Code Section 13-72-080. The request itemized:

- Distribution Formula & Validation Data: The specific mathematical breakdown and an anonymized ledger of disbursements to verify the formula matches the total collected

- Leave Policy & Application: The committee’s standardized policy on approved leave and confirmation whether any recipients had their portion reduced this cycle

- Administrative Costs & Resources: A line-item accounting of all fees, charges, and deductions from the fund, plus any Association records reflecting resources used to administer the program

Under Illinois law, the Association must respond within ten business days.

The deadline is Mon, Feb 2, 2026.

As of publication, the Association has not acknowledged or replied to this request. Having said that, I’m hopeful they will provide all of the requested information before the deadline expires.

Alicia Williams, Jan 16, 2026

Dear Drew,

We hope your holidays went well also. We received your email asking questions about the 2025 holiday fund. Our response is below.

The Distribution Formula: Please provide a copy of the criteria and/or formula used to determine the specific amounts awarded to HOA employees and Sudler’s contract staff.

The criteria are not differentiated by HOA employees and Sudler staff, but by tenure. As you know, several of the Sudler staff have come on board within the last couple of years and represent 15.6% of the 32 employees. The Committee reduces the bonus amount for those with the least amount of tenure. Specifically, staff employed less than 5 years received smaller amounts.

Policy on Approved Leave: I would like confirmation on whether employees who were on approved leave (such as for injury, extended illness, or other guaranteed medical leave) had their portion of the fund reduced or prorated based on their time away.

Different types of leave and part-time work is dealt with on a case-by-case basis and handled by consensus of the committee members. As you know, there are many potential privacy issues for different types of leave and part-time work.

Financial Records: Please provide copies of all bank statements associated with the Holiday Fund, as well as a line-item accounting of program costs including, but not limited to, third-party provider fees, processing fees, or management fees deducted from the fund before distribution.

The account is accessed online. The account is active, for about 3 months (November, December and January). Reports from this account would list everyone that contributes to the fund and the amount given. For privacy reasons, individual contributions are not made public as it is a personal choice to participate in the holiday fund and not mandatory. Also, we specifically inform residents that their contribution will remain private.

We are in the second year or using electronic payments rather than requiring a physical check. More people used Zelle in 2025 than in 2024 because we were able to address the issues we encountered with accepting contributions last year. The Zelle process ran smoothly.

The 2025 holiday fund received about $120,000 in contributions. Of this amount, $102,000 was disbursed to 32 employees at their holiday party on December 18th. Every year, we receive additional money after the deadline and some checks do not clear. Based on those funds, there will be a second distribution later this month. Fees on the account were $5.00 monthly.

Alicia and Nike on behalf of the Holiday Fund Committee

Drew McManus, Jan 17, 2026

Thank you both so much for your email, I appreciate the time you took. I am writing to acknowledge that message and while I appreciate the summary provided, the response was insufficient and appeared to construct unnecessary hurdles to transparency by addressing questions I did not ask.

To ensure the record is clear, and to prevent any further delays based on misunderstandings, I must address several specific points in your refusal to provide the requested documentation:

- The “Privacy” Deflection: You declined to provide records based on the privacy of individual disbursements. My original request explicitly stated I was not looking for names or individual pay figures. What is the specific risk in providing the math if no names are attached?

- The “All-or-Nothing” Document Myth: You mentioned that bank records would reveal donor identities, yet every professionally managed fund maintains an independent ledger to track outgoing payments. How are you tracking the $102,000 in disbursements without a ledger that is separate from the bank’s deposit feed? What prevents you from providing a copy of the expenditure ledger that simply lists the amounts paid out and when those payouts are not to an employee, including that payee information?

- False Precision: Your response noted that new staff “represent 15.6% of the 32 employees.” While this figure sounds precise, it provides zero insight into the financial distribution. Knowing the percentage of people tells us nothing about the percentage of dollars allocated. Moreover, the number of employees has changed. In the print flyer distributed to owners under their door, it states 31 employees while the email sent to owners on 1/16/2026 lists 33 employees. Providing a statistic without the underlying formula creates the illusion of transparency without the substance. How am I to rely on the accuracy of these percentages when the total number of recipients changes with every communication?

- “Consensus” vs. Policy: You stated that leave is handled by “consensus.” In the context of financial governance, “consensus” without a written standard suggests subjective decision-making, which opens the Association to liability regarding fairness and discrimination. A request for a “policy” cannot be satisfied by a description of a “feeling.”

To eliminate any further ambiguity, please consider this a formal request for the inspection of association records pursuant to Section 19 of the Illinois Condominium Property Act (765 ILCS 605/19) and Chicago Municipal Code Section 13-72-080.

To fulfill this request, you are required to provide the following specific records:

1. The Distribution Formula & Validation Data

- The Criteria: The specific mathematical breakdown (tiers, percentages, or dollar amounts) used to calculate the disbursements. A vague reference to “tenure” is a description, not a formula.

- Headcount Confirmation: A definitive statement confirming the exact number of unique individuals who received a disbursement from the fund total. This is necessary to resolve the conflicting figures of 31, 32, and 33 recipients previously provided by the board and the committee.

- Validation Ledger: An anonymized list of the 32 specific amounts disbursed (e.g., “Recipient 1: $X, Recipient 2: $Y”). This list must have all names and titles removed. As I am not asking for the names attached to these amounts, there is no privacy concern. The purpose is solely to verify that the mathematical formula provided was applied consistently to match the $102,000 total.

2. Leave Policy and Impact

- The Policy Logic: The committee’s standardized policy regarding recipients on approved medical or injury leave (specifically, whether such leave results in a prorated reduction).

- Confirmation of Application: A direct confirmation as to whether any recipient(s) in this cycle had their portion of the fund reduced or prorated specifically due to time spent on approved leave.

- Note: Do not deny this request based on “medical privacy.” I am asking for a “Yes” or “No” confirmation regarding the application of a financial rule to the group, not the medical history of any individual.

3. Accounting of Administrative Costs & Resources

- Fund Expenditures: A line-item accounting of all expenditures, debits, or deductions from the Holiday Fund account for any purpose other than the direct disbursements to staff. This includes all third-party provider fees, Zelle-related charges, bank service fees, or management fees.

- Note: Do not deny this based on “donor privacy.” I am requesting records of money leaving the account (expenses), not the list of donors contributing to it.

- Association Resources: Any and all Association records—including but not limited to general ledger entries, invoices, or billing records—reflecting Association funds or resources used to facilitate the administration, collection, or distribution of the Holiday Fund.

Statement of Purpose: The purpose of this request is to verify the financial integrity of the fund, ensure the objective application of distribution rules, and audit the use of Association resources, including contracted management personnel and general funds, utilized to administer this program. This is a proper purpose relating to my interest as a unit owner.

Certification of Non-Commercial Use: I certify that the information obtained from these records will not be used for any commercial purpose or for any purpose that does not relate to my interest as an association member.

Per Illinois law, the Association is required to make these records available within ten (10) business days. Please let me know when these documents will be available for inspection or if they will be delivered electronically.

Regards,

Drew McManus

Unit 7908

What Owners Should Know

The Holiday Fund is a generous tradition. Owners contribute voluntarily, staff receive recognition, and the committee donates time to organize it. None of that is in dispute nor is anyone criticizing members for volunteering their time.

What is in dispute is whether a program handling six figures annually, using Association resources, and administered by Board-appointed directors can refuse to answer basic questions about how it operates.

Nike Whitcomb’s email-fail revealed potential intent: the decision to deny transparency was made before any discussion of privacy or policy. The rationale was not about protecting employees or donors. It was about who was asking and what they might do with the information.

If transparency depends on who is asking, how is that governance?

The formula should be public. The leave policy should be written. Anonymized financial records should be available. These are not unreasonable asks; they are minimum standards for any fund soliciting contributions under the Association’s name. If the committee’s practices are sound, transparency costs nothing. What’s the downside of making the formula and records available before owners are asked to contribute again?

Bonus Content

The Deflection Playbook

If you’re the kind of person who likes to see how these things work line by line, I put together a point-by-point breakdown of my questions and the committee’s responses. It shows exactly where answers were provided, where they weren’t, and where the conversation shifted away from the information owners actually asked for. It’s a great resource for learning how to identify when someone is using the Deny-Delay-Deflect tactic to your questions!

1) Distribution Formula

What I asked: The distribution formula, meaning the actual math used to determine specific disbursement amounts.

What Williams provided: “The criteria are not differentiated by HOA employees and Sudler staff, but by tenure… staff employed less than 5 years received smaller amounts.”

DENY

No tier breakdown, percentages, or formula was provided.

Delay

The actual tiers and math needed to verify the distribution are missing.

Deflect

“Tenure based” describes the concept, not the calculation.

2) Approved Leave Policy

What I asked: Whether and how approved leave is handled in the distribution process.

What Williams provided: “Different types of leave and part time work is dealt with on a case by case basis and handled by consensus of the committee members.”

DENY

No written standard was provided.

Delay

A documented rule and confirmation of consistent application was missing.

Deflect

A “case by case” approach is not a policy owners can evaluate or verify.

3) Financial Records (Money Going Out)

What I asked: Financial records and a line item accounting of fees deducted before distribution.

What Williams provided: She declined bank statements because reports would “list everyone that contributes to the fund and the amount given,” citing privacy.

DENY

The records needed to verify deductions and payouts were not provided.

Delay

Expenditure side documentation, including deductions, fees, and disbursement support were missing.

Deflect

This deflects by reframing the request as a donor privacy issue, even though I asked for anonymized records showing money going out, not donor deposits coming in.

4) Headcount Confirmation

What I asked: A definitive headcount of recipients so the totals can be verified.

What Williams provided: “15.6% of the 32 employees…”

DENY

No reconciliation of the inconsistent counts was provided.

Delay

A definitive number and explanation for the discrepancy was missing.

Deflect

A percentage statistic projects the appearance of providing details, but it doesn’t resolve conflicting recipient totals.

5) Anonymized Disbursement Ledger

What I asked: An anonymized list of disbursement amounts, without names attached.

What Williams provided: Not addressed.

DENY

No response to the most straightforward verification request.

Delay

Any confirmation or ledger that allows owners to validate the math was missing.

Deflect

Failing to acknowledge the request is deflection going pro!